EL TALADRO AZUL

Published in Zignox. June 27, 2023

Despite expectations of a potential recession induced by rising interest rates, the oil global demand continues to track at 101 MMbpd with no signs of slowing down anytime soon. How a still hawkish monetary policy will affect the global energy balance?

Juan M. Szabo and Luis A. Pacheco

China's economic recovery has fallen short of expectations, and the less rosy reality is tempering the oil markets' initial excitement about better prospects. And while the eastern giant's industrial recovery has not been up to par, with consumer-oriented sectors underperforming, the decision by the People's Bank of China to cut two benchmark interest rates by just 10 basis points each, is considered too small to make a difference. Therefore, the topsy-turvy reaction among market players was undoubtedly a foregone conclusion.

On the other side of the world, the story is somewhat different, although the impact on the market has been the same. The Bank of England surprised many by raising interest rates from 4.5% to 5%, stoking fears of a recession in the Old Continent. This was not a solo increase, as the European Central Bank had announced a 0.25% hike, and central banks in Norway and Switzerland raised interest rates on the same day as the BOE. Also, the Federal Reserve in the US warned that two additional increases can be expected for the remainder of 2023. The central banks' strategy, and their consequential macroeconomic projections, have undermined confidence in the oil demand outlook, pushing prices down.

We face an oil anomaly. In one part, the perception that the oil market is in a “bearish mode” amid the expectation of a potential recession --that eventually the central banks will turn into an extended one-- as a way to subdue inflation. On the other hand, the market observes that for now and for the foreseeable future, world crude oil inventories are low and decreasing, a situation that could become critical if we consider that current consumption is at historical highs. These two sides of the market, negative sentiment and critical inventories, are engulfing the oil market in what some call “cognitive dissonance”.

Global Supply

Non-OPEC+ supplies continue without showing signs of improvement. The US, the largest oil producer, continues to lose ground by experiencing a further reduction in active rigs, with -6 this week or 71 less than 12 months ago. The second-largest producer, Brazil, is plateauing at 3.2 MMbpd, with a decline that it will not be able to offset until the newly added rigs start supplying additional output potential, estimated for the end of the first quarter of 2024.

On the OPEC+ side, the only foreseeable change is the cut of 1.0 MMBPD announced by Saudi Arabia for July, the effect of which could be neutralized with the floating inventories they maintain on the coast of Egypt. So, there are no major-scheduled changes, although the beginning of the hurricane season in the Gulf of Mexico, as well as the unexpected events in Russia, could generate temporary interruptions in oil production.

An analysis of drilling activity reveals that the few countries that show an increase in activity are more than offset by declines in other regions: The net result is a reduction of 18 rigs year to date.

Closer to the Latin American region, Ecuador will soon vote on legislation to ban production at one of its main oil blocks. According to public polls, the proposed bill has a high possibility of being approved in August. The issue concerns block 43-ITT in the Amazon region of Yasuní, which includes the Ishpingo, Tambococha and Tiputini (ITT) fields, where the state-owned oil company, Petroecuador, began operations in 2016. If the legislative initiative is approved, Ecuador would reduce its production by some 60 Mbpd, a reduction in oil revenue of more than USD1 billion/year.

The completion of the gas pipeline to transport Vaca Muerta gas from southern to northern Argentina could put a few additional barrels of oil on the market, as a good portion of the gas to be transported is associated with oil. However, as is often the case in state-run activities, now that there is an infrastructure in place, there are no wells.

Global demand

The global demand continues to hover at 101 MMbpd and has not shown the signs of reduction that one would expect given the expectation of a recession induced by interest rate hikes: the market has been slow to digest or believe these signals.

Although China has maintained its pace of crude imports, it seems that part of these volumes is being stored in its strategic reserve, as the internal demand for fuels is below estimates.

The Netherlands, after much discussion, has announced the upcoming October 1 as the final closure date for Europe's largest gas field, Groningen. The replacement of this gas in Europe will come from greater imports of LNG and from the increase in demand for crude oil.

The demand for aviation fuel, like the demand for oil for its transformation into petrochemical products, remains strong and with a tendency to grow, both in Asia and North America.

The Basics: Demand/Supply Equation

From all of the above, we can infer that, for now, prices will remain volatile, reacting to a kind of "ping-pong" between the reality of the physical market and the emotion induced by emerging news.

During the week, Brent and WTI prices reached lows of USD72/bbl and USD68/bbl, respectively, but on Friday prices experienced a recovery of USD2/bbl and USD1.5/bbl for Brent and WTI respectively.

Finally, although the political-military crisis in Russia quickly deflated, the situation could still lead to instability that infects the markets in general and the energy market in particular. Let's not forget that Russia's oil and gas production is a cornerstone of the global energy system.

Venezuela, Politics, and Economy

The situations and events this week that have the greatest repercussion in the political/economic field that could have an impact on the future of the hydrocarbons industry are:

• The Maduro regime continues to refuse to return to negotiations with the opposition, in Mexico.

• The resignation of all members of the National Electoral Council (CNE), under pressure from the Venezuelan regime, further weakens the legitimacy of any electoral process going forward.

• Roger Carstens, the US special envoy for hostage affairs, once again visited Venezuela. Their presence, and other recent visits by major Venezuelan debt holders, could indicate that there are talks between the US administration and the regime in Venezuela to lift the sanction that prevents the transactions of sovereign debt and PDVSA bonds, in exchange for the release of some political prisoners.

• The Central Bank of Venezuela (BCV) confirmed that, during the first 5 months of 2023, inflation has reached 100%.

• During the month of June, the bolivar has already lost 5% of its value in the parallel market, fueling inflation and the deterioration of the purchasing power of the population.

Hydrocarbons

Production: During the last months, crude oil production has stabilized, affected only by power outages, including the explosion of a PDVSA substation in Bachaquero, in western Venezuela, which affected some fields on the eastern shore of Lake Maracaibo: Barúa, Motatán, and Franchise.

An explosion was also reported in the eastern region, at the Tejero Operations Center (COT), in Punta de Mata, where both light crude oil and gas are processed and compressed; the production could be negatively affected and in addition to an increase in venting and gas flaring. Downstream, processing could also be reduced or stopped altogether at the Puerto la Cruz refinery; also, the capacity to blend Merey 16 crude could also be affected. Information has been too scant to fully assess the damage and its consequences.

In sum, the average production for June seems to be 710 Mbpd. The geographical distribution of production, showing Chevron's contribution in parentheses, is presented in the following table in thousands of barrels per day (Mbpd):

• West 100 (48 Boscán)

• East /South 162 (could change depending on the accident)

• Orinoco Belt: 448 (70 PetroPiar and PetroIndependencia)

• TOTAL: 710 (Chevron 119)

The production of the joint ventures (JVs) operated by Chevron has reached as high as could be expected, considering that investments are not allowed under the OFAC General License (GL41 ) currently in force. The expected extension of the license has not occurred due to the suspension of the negotiation process in Mexico. Production in the West shows a certain upturn with the activation of wells in the Franquera Field.

Active drilling rigs in the country increased to 2, both operating for PetroMonagas in the Orinoco Belt. They are drilling and casing surface wells in tandem. People close to the operations report that both units are in poor mechanical condition, operating only 20% of the time.

Chevron

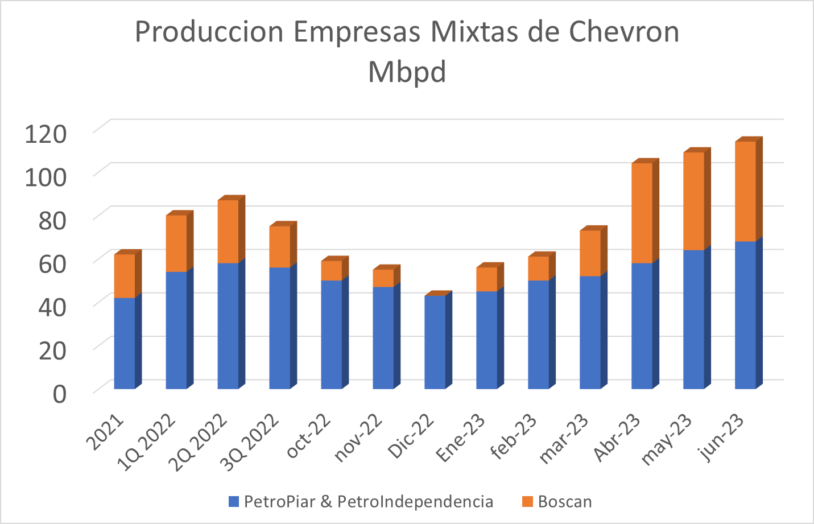

A more detailed analysis of the levels of production in Venezuela recently, with an emphasis on the last eight months, just before the General License 41 was granted, allows us to conclude that the main element in the growth of production during the period, has been the management of production in Campo Boscán, in addition to the efforts of the multinational oil company to reduce deferred production in PetroPiar and PetroIndependencia, in the Orinoco Belt.

As can be seen in the graph, during the first 9 months of 2022, Campo Boscán produced variable volumes, between 25 and 55 Mbpd, mainly subject to fluctuations in the asphalt market in the Far East, where the production was going. During the negotiations of the terms of GL41, the field was closed and returned to production once the License was issued by OFAC, reaching a production close to 50 MBPD, equal to its production before the “strategic” closure.

Chevron’s joint ventures in the Orinoco Belt received a different treatment. The decrease in production before 2023 was slight and a result of reduced maintenance activity, possibly to keep the upgrader at Jose operational. Once the license was granted, the recovery was gradual, since it was not just about opening valves, but also service and repair activities that only began after the license was granted. Also, problems with the reservoir have raised further complications: the increasing water invasion in some sectors of the exploitation block assigned to PetroPiar.

Downstream

The Venezuelan refining system has processed 230 Mbpd of crude and intermediate products. Most of it in the Paraguaná refineries (Amuay and Cardón, in western Venezuela), where ongoing operational problems in the catalytic cracking units (FCC) have limited the quantity and quality of gasoline supplied to the domestic market, producing only improved naphtha using reformer products.

The Puerto la Cruz refinery, in eastern Venezuela, has also been operating and producing reduced volumes of gasoline and diesel, constrained by crude availability; the accident in El Tejero, may restrict further the availability of light crude oil.

Although the start-up of the El Palito refinery in the central region was announced once again, that operation is still unstable. To the best of our knowledge, no product has been delivered to the local market, although a shipment of naphtha was received from Paraguaná, possibly for the FCC start-up or to distribute as gasoline in central Venezuela.

The President of the Iranian Engineering Company (NIOEC), Farhad Ahmadi, in charge of the overhaul project, announced that El Palito refinery will be operating at capacity in about two months after the repair works are completed. PDVSA has not made an official comment.

Gasoline shortages have eased somewhat in places like Caracas and Valencia, although they remain critical and are exacerbated by shipments to Cuba, and the flow of contraband to Colombia, which has not stopped despite low availability of the fuel. It is expected that a shipment of Iranian gasoline will arrive in Venezuela in a few days.

Exports

It seems that June will close exports at around 500 Mbpd of crude. Although several vessels are anchored around the Jose terminal waiting to be loaded, the limitation is cargo capacity. Exports made and scheduled for June are shown below:

• 36 Mbpd were exchanged under the ENI/Repsol agreement.

• 30 Mbpd were sent to Cuba.

• 132 Mbpd are estimated under the Chevron License for PADD 3, in the US.

• 302 Mbpd in tankers to the Far East: 70 Mbpd through Iranian swaps and 232 Mbpd through intermediaries, both with China as final destination .

Additionally, around 75 MBPD of fuel oil was exported to Cuba and Singapore.

Income: Of the 575 MBPD of crude oil and products exported, only 374 of them generate income in foreign currency. We estimate that these barrels will bring $514 million to the Venezuelan regime.

________________________________________

Note: A version of this article was published in Spanish by La Gran Aldea on June 27, 2023.