M. JUAN SZABO / LUIS A. PACHECO

Esta semana confluyeron varios factores del lado del suministro que en suma le dieron un empuje a los precios al alza. Las interrupciones de producción en Libia, Nigeria y México, aunadas a la aparente robustez de los compromisos de recorte de Arabia Saudita y Rusia, elevaron los precios del barril a sus niveles más altos de los últimos tres meses. A eso se le añadió la reducción en las cifras de inflación en EE.UU., que parece respaldar el moderado éxito de las políticas de restricción monetaria de la Reserva Federal, y presagiar que las tasas de interés estarían cerca de los niveles que se estiman eficaces.

Por otro lado, esa misma efervescencia en el mercado movió a los actores del mercado petrolero a tomar ganancias, que en conjunción con las noticias algo ambiguas provenientes de China, motivó una “venta masiva de posiciones” que moderó los precios petroleros antes que el mercado cerrara para la semana.

Aunque sea por los momentos, la oferta petrolera se ha estrechado en más de 2,0 MMbpd, en virtud del aparente cumplimiento de los cierres de producción anunciados por Arabia Saudita y Rusia, que entre los dos suman 1,5 MMbpd.

Adicionalmente, en Libia, unos 350 Mbpd de crudo proveniente de algunos de los yacimientos más prolíficos, incluyendo El-Sharara, fueron cerrados a partir de la mitad de la semana. La rivalidad entre las facciones, agravada por protestas de las tribus locales por el secuestro de un exministro, provocó la interrupción en la producción -al cierre de esta edición se anunciaba la reapertura del campo de producción.

En Nigeria, debido a una supuesta fuga en el oleoducto que conecta a la boya de carga, SPDC (Shell Petroleum Development Company of Nigeria)parece haber restringido la carga de tanqueros desde el terminal de Forcados, localizado en la boca del río del mismo nombre, afectando unos 300 Mbpd hasta que se remedie el problema.

En el otro lado del mundo, y debido al accidente sufrido por Pemex en sus operaciones de Sonda de Campeche, se cerró inicialmente la producción en la zona, unos 700 Mbpd (casi la mitad de la producción de México). La producción ha venido recuperándose, pero los últimos 150 Mbpd, directamente relacionados con la compresión de gas que quedó destruida por el incendio en la plataforma Nohoch Alfa, requerirá de más tiempo y esfuerzo para ser reactivado.

EE.UU. continúa sin aportar volúmenes significativos a la composición del suministro. Esta semana, el reporte de Baker Hughes de taladros de perforación de pozos mostró una reducción de 5 taladros netos; en la Cuenca del Permian, la más atractiva para revertir el estancamiento, la contracción fue de 8 unidades. Por el contrario, tanto Arabia Sauditacomo los Emiratos Árabes Unidos (EAU), están incorporando taladros de perforación, según data del mismo reporte.

Por el lado de la demanda emergen señales mixtas, pero lo más relevante son las señales de letargo económico que vienen de China, siendo la duda principal la capacidad del Gobierno de poder estimular su economía. En todo caso, el mes de julio presenta importaciones de crudo marcadamente inferiores a los altos niveles logrados en junio. Parte de los altos volúmenes de importación fueron a engrosar las reservas estratégicas, que a diferencia de las de EE.UU., están prácticamente llenas a capacidad.

Dos de las organizaciones internacionales más influyentes en el mundo de la energía, son la OPEP y la Agencia Internacional de la Energía (IEA, por sus siglas en inglés), que publican regularmente pronósticos sobre la energía y en particular sobre el petróleo. Sus análisis, como es de esperarse dada sus diferentes agendas, rara vez coinciden; a veces parece que estuvieran analizando mercados del petróleo diferentes.

La OPEP, por ejemplo, elevó su pronóstico de crecimiento de la demanda de petróleo para 2023 y pronosticó solo una leve desaceleración en 2024. Según su análisis, a pesar de los obstáculos económicos, China e India continúan impulsando la demanda. En su informe mensual, la OPEP indica que la demanda mundial de petróleo aumentará en 2,25 MMbpd en 2024, un aumento del 2,2%, en comparación con el crecimiento de 2,44 MMbpd en 2023. El análisis considera que las variables demográficas, el crecimiento económico y una modesta competencia de alternativas energéticas viables son la fundación de creciente demanda1.

La IEA sostiene que la demanda petrolera está bajo la presión del entorno económico y su reacción al drástico endurecimiento de la política monetaria en muchos países avanzados.

Aun así, pronostica que la demanda mundial de petróleo aumentará estacionalmente en 1,6 MMbpd del segundo al tercer trimestre de este año, logrando un promedio de 102,1 MMbpd para todo el año, un nuevo récord. El crecimiento se desacelerará a 1,1 Mbpd en 2024, a medida que la recuperación pierda impulso y se afiancen medidas cada vez mayores de electrificación y eficiencia de la flota de vehículos.

Estos pronósticos, aunque marginalmente diferentes a los de la OPEP la energía y el cambio climático, sí apuntan hacia una demanda en descenso, reflejando el mandato político de la IEA, de impulsar la transición energética a la mayor velocidad posible.

Las complejidades de un mundo con conflictos armados de larga duración, intereses no alineados entre los países ricos y los países pobres, barreras económicas y técnicas en el despliegue de energías alternas, entre otras variables, nos llevan a concluir que, por ahora, el reemplazo en gran escala de la energía fósil no avance con la rapidez que la IEA asume en sus análisis de corto plazo. El pronóstico de la OPEP, interesado sin duda, nos parece por ahora como más probable.

En resumen, los posibles efectos sobre la demanda de una potencial recesión, por un lado, y las limitaciones coyunturales y estructurales en el suministro, por el otro, se han decantado por mantener los precios del crudo en una banda.

La OPEP+ está determinando un precio piso, por su capacidad de cerrar y abrir producción. Por el otro lado, la economía China establece un precio techo con su menos que óptimo desempeño económico, reforzado por su capacidad de utilizar sus reservas estratégicas de crudo para evitar que los precios se desborden.

En este rango, la semana mostró un aumento significativo en los precios con respecto a la semana anterior. El crudo Brent rozando los 82 dólares/bbl, pero las noticias recibidas de China provocaron ventas masivas de contratos petroleros, de forma que al cierre del mercado los precios retrocedieron, tranzando al final de la sesión en 79,87dólares/bbl y 75,42 dólares/bbl para los crudos Brent y WTI respectivamente.

Finalmente, varias noticias importantes están en pleno desarrollo, pero su efecto sobre el balance petrolero todavía se desconoce. Entre las más relevantes:

- Rusia incrementó por encima de en 60 dólares/bbl el precio de su crudo Ural, una medida que luce desesperada para tratar de lograr ingresos adicionales. Sin embargo, India, su segundo mejor mercado, podría vetar la compra de petróleo a esos precios, por el temor a ser sancionados. Los bancos locales en India exigen pruebas de que el precio del envío de petróleo está por debajo de 60 dólares/bbl -recordemos que este es el techo que le impusieron las sanciones económicas.

- La ola de calor en Europa está afectando la producción de las plantas nucleares de Bugey y Saint Alban, en Francia, debido a las regulaciones ambientales sobre el uso de agua de ríos para el enfriamiento de los reactores. La generación de energía nuclear en Francia constituye alrededor del 70% de la matriz eléctrica del país, lo que convierte a Francia en un exportador neto de electricidad a otros países europeos, cuando sus reactores están en pleno funcionamiento.

- ExxonMobil (NYSE: XON) acordó comprar a Denbury Inc. (NYSE: DEN) por 4,9 $MMM en acciones. Esta adquisición busca acelerar la presencia de la trasnacional en el campo de la transición energética, con una operación ya establecida de Captura, Uso y Almacenamiento de carbono (CCUS: por sus siglas en inglés). La adquisición, que le da a Exxon, entre otras ventajas, acceso a capacidad de transporte de CO₂ lista para usar. Denbury también tiene un negocio de producción de petróleo y gas.

- California, el séptimo mayor productor de petróleo crudo de EE.UU., ha suspendido, casi por completo, la emisión de permisos para perforar pozos nuevos este año, según datos estatales. La División de Gestión de Energía Geológica del estado, conocida como CalGEM, aprobó solo siete nuevos permisos 2023, en comparación con los más de 200 que había emitido para esta época el año pasado. Más de 1.400 solicitudes no han sido respondidas.

- Shell (SHEL.L) ha realizado un cuarto descubrimiento de hidrocarburos en aguas ultra profundas en Namibia, una de las provincias exploratorias de mayor interés en alta mar. La empresa, asociada con la francesa TotalEnergies (TTEF.PA) confirmó la presencia de hidrocarburos en el pozo Lesedi-1X en aguas ultra profundas de Namibia. Las indicaciones de los tipos de yacimientos descubiertos por Shell y Total sugieren una provincia petrolera de características similares a los descubrimientos en Guyana en el otro lado del Atlántico.

Transición energética, Tierras Raras

Hace pocos días, China anunció que restringirá la exportación de galio y germanio, dos minerales considerados críticos en la producción de semiconductores, celdas solares y otros sistemas asociados a la electrónica, de la que depende mucho de la vida moderna y la naciente transición energética.

De acuerdo con lo anunciado por el Ministerio de Comercio chino, estos minerales y más de tres docenas más de metales relacionados, y otros materiales, serán sujeto de controles de exportación desde el 1 de agosto de 2023. Según el gobierno chino, estas restricciones están enmarcadas en consideraciones de seguridad e intereses nacionales, mas pareciera ser una profundización de la guerra comercial que el gigante oriental lleva adelante con los EE.UU., quién ya había impuesto restricciones a sus exportaciones de óxido de galio en 2022 y otras restricciones asociadas a la fabricación de chips informáticos.

Esta no es la primera vez que China ha puesto restricciones en la exportación a materiales claves en la industria electrónica, en particular los llamados elementos de tierras raras (REE: por sus siglas en inglés), con el fin de mantener su disponibilidad para su industria manufacturera y además subrayar su control sobre la cadena de suministro global.

A principios de la década de 1990, China comienza a exportar REEs después de descubrir, en la década de 1980, grandes depósitos en el interior de Mongolia, y se convierte rápidamente en el mayor proveedor a nivel global. Ya en el 2005, China comienza a aplicar aranceles a la exportación de tierras raras para conservar los recursos y proteger el medioambiente; desde entonces el Gobierno ha venido instrumentando diferentes medidas para resguardar su posición dominante en el mercado de tierras raras. Según la Agencia Internacional de la Energía (IEA: por sus siglas en inglés) en el 2019 China produjo 87% de las tierras raras, y continúa siendo el peso pesado en el sector.

En febrero de 2021, el presidente de Estado Unidos, Joe Biden, firmó una orden ejecutiva destinada a revisar las deficiencias en las cadenas de suministro de tierras raras, dispositivos médicos, chips informáticos y otros recursos críticos del país. En marzo del mismo año, el Departamento de Energía de EE.UU. anunció una iniciativa para investigar y asegurar las cadenas de suministro nacionales de tierras raras y metales para baterías como el cobalto y el litio. En junio de 2022, Biden invocó la Ley de Productos de Defensa para aumentar la producción nacional de minerales críticos como las tierras raras, así como para financiar estudios de viabilidad y ampliar los recursos existentes.

¿Qué son Tierras Raras?2

Las tierras raras, también llamados elementos de tierras raras u óxidos de tierras raras, son un grupo de 17 elementos metálicos, ubicados en el medio de la tabla periódica (números atómicos 21, 39 y 57-71), del grupo de los lantánidos. Estos metales tienen propiedades fluorescentes, conductoras y magnéticas inusuales, lo que los hace muy útiles cuando se alean o mezclan en pequeñas cantidades con metales más comunes y son materiales cruciales en la electrónica moderna.

Algunos de los nombres de estos minerales se derivan de los nombres de los científicos que los descubrieron o establecieron sus propiedades, mientras que otros fueron nombrados por el lugar donde fueron descubiertos:

Geológicamente hablando, los elementos de tierras raras no son ni tierras ni particularmente raros. Los depósitos de estos metales se encuentran en muchos lugares en todo el mundo, con algunos de ellos en la misma abundancia en la corteza terrestre que el cobre o el estaño. Pero, al contrario de esos últimos, las tierras raras nunca se encuentran en concentraciones muy altas y generalmente se consiguen mezcladas entre sí o con elementos radiactivos, como el uranio y el torio, lo que hace compleja su manipulación y separación. Además, el proceso de separación de tierras raras entre sí es tecnológicamente complejo y costoso.

El mercado de metales de tierras raras se estimó en 5.300 millones de dólares en 2021 y se prevé que alcance los 9.600 millones de dólares en 2026; con un crecimiento anual del 12,3% de 2021 a 2026.

La producción de tierras raras involucra varios procesos complejos:

- Se extraen de minas a cielo abierto o subterráneas, al igual que otros metales. Los principales países productores son China, Estados Unidos, Birmania y Australia.

- El mineral se tritura y muele en polvo fino para liberar los elementos de tierras raras que contiene. Esto facilita su posterior separación.

- Se usan técnicas como extracción con solventes o intercambio iónico para separar las tierras raras entre sí. Esto es complicado, ya que sus propiedades químicas son muy similares.

- Una vez separados, se refinan mediante electrólisis o calcinación con ácidos, extrayendo los elementos individuales en forma de óxidos de alta pureza.

- Los óxidos de tierras raras se pueden combinar con otros metales para producir aleaciones con propiedades deseadas, como imanes de neodimio-hierro-boro.

- Las aleaciones y compuestos se manufacturan en productos finales como catalizadores, vidrio, cerámicas, imanes permanentes, baterías, entre otros.

- También se reciclan productos que contienen tierras raras para reutilizar estos materiales.

Las propiedades magnéticas, fosforescentes y catalíticas, únicas de los REEs, los hacen insustituibles para muchas aplicaciones de alta tecnología. Por ejemplo, el neodimio se usa para fabricar imanes fuertes para motores y generadores en vehículos eléctricos, turbinas eólicas y otras aplicaciones de energía limpia. El europio se usa para fósforos rojos en televisores y monitores de computadora. El cerio se utiliza como catalizador en la refinación de petróleo.

Las tierras raras también son esenciales para las tecnologías de defensa, como los motores de aviones de combate, los sistemas de guía de misiles, los sistemas de comunicación y satélite, los sistemas de radar y sonar, y más. Por lo tanto, EE.UU., la UE, Japón y otros también consideran una prioridad de seguridad nacional asegurar cadenas de suministro confiables de tierras raras.

Es probable que los elementos de tierras raras sigan siendo una parte importante de nuestro futuro, desde la computación cuántica y las ciencias de los materiales hasta las aplicaciones médicas y los avances en tecnología ecológica. Los cambios en curso de los automóviles de combustión interna a los vehículos eléctricos también aumentarán la demanda de imanes y baterías de tierras raras.

En el contexto de transición energética, donde el sistema migra de seguridad de suministro de petróleo a seguridad de suministro de minerales, no solo de tierras raras, sino en mayor escala de cobre y el litio, entre otros, la geopolítica de las fuentes de suministro será también un factor importante para considerar, cuando de proyectar el despliegue de las nuevas tecnologías se trate.

Para satisfacer la demanda futura, las empresas mineras han propuesto abrir nuevas minas y construir nuevas plantas de procesamiento en muchas partes del mundo. En países que tendrán sus propios retos ambientales y sociales. Algunos planes suenan extravagantes, como la minería en aguas profundas o la extracción de tierras raras de las aguas residuales ácidas que se drenan de las minas abandonadas. Estas técnicas de producción podrían volverse económicamente viables si un gran aumento en la demanda hace subir los precios o si los gobiernos deciden subsidiar los costos de producción.

A diferencia de los precios del petróleo, el oro y la plata, los precios de los elementos de tierras raras son difíciles de conseguir, ya que no existe un intercambio público ampliamente utilizado para las tierras raras. Empresas como Argus Rare Earths publican evaluaciones de precios regulares basadas en encuestas de comerciantes, consumidores y otros participantes en el mercado.

Venezuela

Eventos Políticos y otros:El régimen, confrontado con un comportamiento inusualmente positivo de la oposición y el auge que ha alcanzado el interés de votar y aglutinarse alrededor de la candidatura de María Corina Machado, parece haber decidido eliminar cualquier vestigio de posibles elecciones justas y verificables, usando el Poder Legislativo y Judicial como instrumentos político-partidistas.

Ni las reuniones secretas en Catar entre los representantes de la administración Biden y representantes del régimen de Maduro, ni los esfuerzos de la Plataforma Unitaria Democrática (PUD) en Washington, han logrado destrabar las paralizadas negociaciones de México. Por el contrario, la administración de Biden está, aparentemente, endureciendo su tratamiento de las sanciones por la falta de colaboración del régimen. Esto al final redunda en la capacidad de recuperación la industria petrolera venezolana, que es lo que nos ocupa. Por el lado económico, la inflación continúa aumentando y la tasa de cambio rompió el techo de 30 bolívares/dólar.

Según fuentes cercanas al régimen, el Ministerio de Petróleo estaría por aumentar los precios del gas natural en el mercado doméstico, con el objeto de ir eliminando gradualmente los subsidios a los combustibles. El plan es el de triplicar los precios de este combustible a las empresas y fábricas que usan gas en sus hornos, calderas y calentadores; pagarán 3,3 dólares/MMBTU, un aumento importante versus el precio anterior de 1,13 dólar/MMBTU.

Sector Hidrocarburos

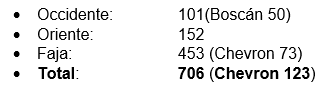

Producción: La producción semanal continúa afectada por el cierre de pozos producto de las explosiones en instalaciones en occidente y oriente. La producción semanal promedió 706 Mbpd distribuido geográficamente como sigue:

La producción de las empresas mixtas gestionadas por Chevron (NYSE: CVX) promediaron 123 Mbpd.

Refinación:El sistema nacional de refinerías procesó 225 Mbpd de crudo y productos intermedios. El Complejo Refinador Paraguaná (CRP), nuevamente tiene las dos unidades de craqueo catalítico (FCC) paradas, afectando la producción de gasolina; el reformador de Cardón también se encuentra en mantenimiento. La Refinería de Puerto la Cruz está en operación limitada por escasez de crudo liviano, y la Refinería El Palito está funcionando y produciendo unos 10 Mbpd de gasolina.

Exportaciones e importaciones:Como ya es costumbre, las exportaciones de principios de mes comienzan en niveles moderados y los despachos se espera se incrementen en la última quincena del mes. Las exportaciones de crudo apenas sobrepasan los 300 Mbpd, inclusive las manejadas por Chevron están rezagadas, pero con tanqueros atracados en los terminales o cerca de ellos.

Durante el mes de junio se recibieron 2,1 MMbbls de condensado iraní, manteniendo así los inventarios de diluente a niveles normales. A finales del mes está programado recibir 500 Mbbls de nafta pesada traída por Chevron para diluir sus crudos de la Faja a segregaciones Merey y DCO. Por cierto, en los documentos de la aduana de EE.UU. se observa que un cargamento de crudo venezolano, exportado por Chevron fue vendido a ExxonMobil, siendo este la primera compra de crudo venezolano de esa empresa desde el impasse con la administración de Chávez.

—

(1)La agenda política de la OPEP+ es, por definición, extender en el tiempo la vida económica de los recursos que sus países miembros, extrayendo el mayor valor económico posible.

(2)Esta sección fue desarrollada con la ayuda de https://claude.ai/chats y contrastada con otras fuentes.

—

*La ilustración generada utilizando DALL-E, realizada por Luis A. Pacheco, es cortesía del autor al editor de La Gran Aldea.

—

*M. Juan Szabo, Analista Internacional.

*Luis A. Pacheco, non-resident fellow at the Baker Institute Center for Energy Studies.