El Taladro Azul

M. Juan Szabo [1] y Luis A. Pacheco [2]

Published Originally in Spanish in LA GRAN ALDEA

A week is a long time in today's economic and political situation. The extrapolation of trends created by President Trump's tariffs and commercial upheaval and the intuition that production increases announced by OPEC+ would only materialize partially suggested rising prices. However, the market's unpredictability struck again, and the week's events and news pressured oil prices downward.

- OPEC+ indicated it is debating whether to implement another production increase starting in July 2025, which would bring the total barrels "returned" to the market to close to 1.5 million barrels per day (MMbpd).

- President Trump threatened the European Union with 50% tariffs starting in June due to a lack of progress in trade negotiations between the European bloc and the US. In the same tone, Trump notified Apple that he would impose a 25% tariff if they didn't manufacture the iPhones sold in the US locally.

- The US House of Representatives approved Trump's controversial fiscal package by a narrow majority. The package includes tax cuts and increased spending and could increase US debt by more than three trillion dollars over the next decade. Trump had to negotiate with various factions of his party that expressed doubts about the proposed law. The package now goes to the Senate, where Republicans have a 53-47 majority, which will likely seek changes. Any changes introduced require the bill to return to the House for a new vote.

- According to the weekly report from the Energy Information Administration (EIA), commercial crude and gasoline inventories increased by 1.4 and 0.8 million barrels (MMbbls), respectively. These changes, in addition to the supply and demand balance, are the arithmetic result of higher refinery processing, overcompensated by higher crude imports by the US.

Most of these events or news pointed toward an oversupplied market by year-end, which was reflected in oil prices. However, today's data on production and demand don't fully support that projection. In any case, the oil market opted to lean toward pessimism.

Fundamentals

News emerging from within OPEC+ displaced the White House as the primary cause of uncertainty traversing the oil market. Some institutions and analysts question the accelerated dismantling of the strategy to keep production volumes close to manage the oil market balance effectively, and therefore, price levels. The fact is that OPEC+, mainly pressured by Saudi Arabia, changed tactics. Although the reasoning justifying it is unclear, their announcements indicate they seem willing to add almost one and a half million barrels per day (1.5 MMbpd) to supply between April and July. The decision to open another 411,000 barrels per day, corresponding to July, is still being debated within the organization, but the mere mention of the possibility has spooked the market.

In light of forecasts published by the IEA for 2025, the market perceives that higher production by OPEC+ and non-OPEC+ countries, coupled with a marked deceleration in demand growth, may be the origin of a perfect storm for prices. There are others, the few, who think they detect a strategy by the Arabs to help the American strategy of lower energy prices in the short term, but which would have the additional benefit of weakening "shale oil" in the medium term. Prevailing prices during recent months have already taken a toll on the production of less profitable crudes.

We have reservations about the formation of the supposed perfect storm. First, announcing global openings is one thing, and materializing the announced volumes sustainably is another. To begin with, as we mentioned last week, the 138,000 barrels per day announced by OPEC+ starting in early April became "salt and water," as the cartel closed the month with production 100,000 barrels per day below March.

Now, the 411,000 barrels per day (411 Mbpd) supposedly being opened since the beginning of May include validation of off-quota productions that Kazakhstan and Iraq were already doing, about 360,000 barrels per day, resulting in a net increase of only about 50,000 barrels per day; this without considering probable production losses from Mexico and Venezuela. OPEC+'s production increase announcement for June, another 411 Mbpd (Saudi Arabia 230 Mbpd, UAE 90 Mbpd, Kazakhstan 60 Mbpd, Libya 20 Mbpd, and Nigeria 11 Mbpd), still doesn't seem sufficient to cope with the demand growth projection for 2025, even considering the reduced growth levels projected by the IEA.

By the end of 2025, it would be necessary to incorporate the production increase of nearly 1.5 MMBPD from non-OPEC+ countries to complete the balance. These increases would come, according to reports from the International Energy Agency (IEA) and OPEC, from the US, Canada, Brazil, and Guyana, which would result in surplus supply, at least in IEA projections, justifying oil market pessimism. However, these projections need to be reconsidered in light of the lower price environment and the expectation that they will remain at those levels for the next 18 months, which will surely modify the growth outlook, especially in the unconventional crude basins.

It's not unthinkable to deduce that US and Canadian production will experience no growth at all, since the price environment doesn't justify development investments in "shale oil" and oil sands. As for Guyana, production will remain constant until the One Guyana FPSO (Floating Production Storage and Offloading) starts up at the end of this year.

Regarding Brazil, Petrobras started operating the FPSO Almirante Tamandaré on February 15, 2025, in the Búzios field, raising Brazil's production to three million six hundred thousand barrels daily (3.6 MMbpd). During the rest of the year, production will begin in two other units: the FPSO Alexandre de Gusmão in the Mero field, and P-78 in the Búzios field. An increase of 140,000 barrels per day is contemplated from these two units. So the incremental production from non-OPEC+ countries, which the IEA projects at one million three hundred thousand barrels per day (1.3 MMbpd) during 2025, would be closer to about 500,000 barrels per day, of which three hundred thousand correspond to the second half of 2025.

The US hydrocarbon industry is reviewing its financial discipline policy to incorporate new market trends. As a result, investment programs are being reduced. Prices projected by alarmists redefine the economic limits of marginal Shale Oil wells. This week, Baker Hughes reports a reduction of another 10 drilling rigs, the most significant weekly activity reduction in a long time. At the same time, the number of fracturing crews falls below 100 for the first time since the pandemic.

Some take this cyclical situation as evidence of what is called "Peak Shale," the beginning of the decline of the "shale oil and gas" revolution. However, there are advanced activities in shales at greater depths than those traditionally exploited in the Permian basin, such as the Woodford and Barnett horizons, where exploration is in its early stages but with very encouraging results; Exxon's XTO division (XOM) is very active in these developments. Advances in seismic (including AI) have allowed drilling bits to navigate these source rocks to build wells with horizontal sections of more than ten thousand feet (3 km), achieving recoveries of one and a half million barrels. A result that, if continued, could considerably extend the useful life of the Permian basin.

The following graph summarizes our estimates for the supply increase.

In our neighborhood, the situation of the Mexican state oil company, Pemex, continues to be concerning. According to its latest results, crude production continues declining, the company generates losses, and its debt keeps growing. Additionally, frequent accidents have generated concerns about the company's industrial safety standards and operations management.

Pemex has announced it plans to cut 3,000 jobs as part of a restructuring aimed at reducing expenses and increasing the exploration and production budget to compensate for the decline of its fields. In April 2025, crude production, including that of private partners, was one million three hundred seventy thousand barrels per day, almost 9% lower than last year. To reverse the production decline and improve financial performance, the company recently announced a plan to reactivate inactive wells with production potential. Pemex says it has around 4,500 wells in that category.

Brazil is reviewing its environmental approval processes to make them more agile, particularly for hydrocarbon activity. Evidence of this is that Petrobras finally received approval for the controversial environmental impact assessment in the Foz do Amazonas basin. Petrobras is preparing to begin offshore exploration of the Amazon delta, which could reverse the eventual decline of the Santos and Campos basins.

Geopolitics

President Donald Trump's government granted Syria a temporary exemption from the sanctions it is subject to. It lifted restrictions on American activity in that country, intending to end a long period of sanctions. This initiative is designed to give Syria's interim government a better chance of survival after more than a decade of civil war. The US administration did not specify the duration of the Congressional sanctions exemption, but the law limits any presidential forgiveness to six months.

Ayatollah Ali Khamenei, Iran's supreme leader, declared that he doesn't expect negotiations with the United States over Tehran's nuclear program to "reach a conclusion," because of the US's intransigent position. Khamenei called the American demand that Iran not enrich uranium a "grave error."

According to Iranian sources, American negotiators have sent contradictory signals about whether they will allow Iran to enrich uranium domestically in a nuclear agreement. As tensions rise in meetings in Rome, regional instability could again push political risk. It should be noted that the US has threatened to attack Iran if it doesn't accept a nuclear agreement. However, Trump didn't explicitly rule out his right to enrich uranium when he reiterated that threat during his Middle East trip last week.

In Gaza, international relations are complicated as Israel carries out its plans to expel Hamas from the strip. The prolonged operation, the crisis of the displaced, and the lack of access to humanitarian aid are reinforcing international opposition against the Israeli campaign. The UN reports that humanitarian aid is beginning to flow to the most needy areas, although much slower than the emergency warrants.

The Houthi rebels, demonstrating they have combat capacity left or are receiving Iranian aid, have launched a large number of missiles and drones against Israel from Yemeni soil. Most have been intercepted, but some caused damage, specifically one that fell on Ben Gurion airport facilities.

Trump and Putin held a phone conversation, which Trump called "excellent" and Putin as "very significant and frank." However, the Kremlin refused to accept a ceasefire in the war with Ukraine, despite pressure from Washington and its European allies. On Friday night, as if to underscore its position, Russia carried out one of the largest missile and drone attacks against Kyiv. The chances of a ceasefire and lasting peace for this conflict are fading. The only positive outcome of recent talks has been a large-scale exchange of prisoners of war, which could reach up to 1,000 on each side.

For its part, China is making plans to leverage its economy and strengthen its dominance over strategic materials. In this regard, it has included in the government agenda a new artificial canal, 767 kilometers long, to connect the rare earth center of the interior, in Jiangxi province, with Zhejiang on the eastern coast. The canal would have the dual objective of reducing logistics costs and integrating less developed interior regions with richer coastal centers.

The dollar, the global economy's historical refuge, headed for its first drop in five weeks against major currencies, and long-term Treasury bond yields remained elevated, due to concern about US debt.

Price Dynamics

Oil prices fell on Friday for the fourth consecutive session, heading for their first drop in three weeks. OPEC+'s renewed announcement of higher production starting in July and deteriorating trade relations between the US and EU allies were the main catalysts. These two announcements truncated, mid-week, the gradual price recovery of the last twenty days. On Friday, prices had a "mini-rally," but it wasn't enough to avoid a loss of almost 1% compared to the previous week.

Thus, at market close on Friday, May 23, the Brent and WTI benchmark crudes were trading at $64.78/bbl and $61.53/bbl, respectively.

VENEZUELA

Maximum Pressure is Written with Crooked Letters

On the eve of regional elections, and perhaps affected by the failure of US special envoy Richard Grenell to neutralize the State Department, the regime intensified repression against its political adversaries to instill some interest in the agonizing regional elections. Opposition leader Juan Pablo Guanipa, an important ally of María Corina Machado, was just one of many detained and accused of forming a terrorist network to attack the May 25 elections. And as is customary, due legal process and detainees' rights have been trampled upon.

According to pollsters, only around 15% of those registered in the electoral roll would attend the May 25 elections, equivalent to the diminished hard base of the PSUV (government party) and the reduced groups that serve as opposition accepted by the regime. Meanwhile, the opposition, which has closed ranks with Edmundo González and María Corina Machado, has agreed not to participate in a process with even fewer guarantees than the one held on July 28, 2024.

As we approach May 27, the expiration date of OFAC Licenses, efforts to prevent the outcome intensified and produced what seemed like a diplomatic success for the revolution. Without warning, Bloomberg reported Richard Grenell's trip to the island of Antigua to negotiate with Venezuelan authorities the exchange of a former American military man, kidnapped in Venezuela, for the possibility of continuing negotiations by extending Chevron's license for an additional 60 days.

The Antigua episode showed that the Trump administration's policy toward Venezuela has two aspects: one of supposed pragmatism, defined somewhat murkily by its coincidence with oil lobbying, whose operator is envoy Richard Grenell; and the other of maximum pressure, aimed at achieving changes toward genuine democracy, whose standard-bearer is Secretary of State Marco Rubio, with support from Republican members of Congress from Florida.

As soon as Grenell's news broke, and after Trump's bill, the "Big Beautiful Bill," was approved in the lower house by the narrowest possible margin, Marco Rubio confirmed that the end date of the "wind down" period for Chevron's license was May 27, as contemplated. The sequence isn't a pure coincidence. This intricate two-time process, which guaranteed the White House the support of the Florida caucus, seems temporarily resolved in favor of the Secretary of State, but we believe we haven't seen the end of this story.

On Friday, oil services company Schlumberger (SLB) paralyzed its operations in the joint venture PetroIndependencia, citing the proximity of May 27. Other service companies are affected by SLB's decision, such as Venezuela's Ensing company, whose EDV-43 rig, which was carrying out completion work on wells drilled during 2024, has been forced to stop its activities.

In that regard, on Saturday, Bloomberg indicated that the State and Treasury Departments are preparing a license (type LG 8), allowing Chevron to maintain limited activity in the country to maintain its assets and guarantee their security. However, there has been no indication from the involved Departments that this is happening.

The shortage of foreign currency and the Maduro administration's decision to dedicate incremental public spending to the May 25 elections have increased monetary financing, printing of inorganic money, and as a consequence of a high injection of dollars into the exchange market, the Bolívar in the official market slipped to 95.08 Bs./US$, barely 0.3% compared to the previous week, which is why the gap with the parallel market shot up to 40%—reviving the ghosts of past hyperinflation.

At the close of this note, as voting time was approaching, it became evident that attendance wouldn't even reach the qualifying level of meager. Since morning, empty streets and electoral centers have been observed. We only need to see what type of announcement the CNE will present at the stroke of midnight.

Oil Operations

As we mentioned in the previous section, oil service companies have begun reducing their activities in preparation for the curtain falling next Tuesday; mechanical and energetic decline, although low, command production activity onwards. Diluent inventories are at high levels, allowing dilution and mixing operations to be maintained for at least two months.

Crude production during the last week averaged eight hundred fifty-one thousand barrels per day (851 Mbpd), distributed geographically as follows:

Area Mbpd

• West 212

• East 124

• Orinoco Belt 515

• TOTAL 851

National refineries processed 224 Mbpd of crude and intermediate products. Cardón's catalytic cracking unit (FCC) continues to operate. Gasoline production was 86 Mbpd and diesel 72 Mbpd.

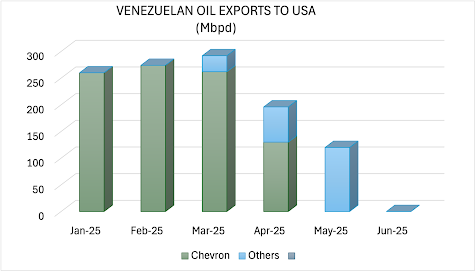

Crude oil exports are projected for May at 580 Mbpd, mainly destined for the Far East, China directly and via Malaysia. Tankers going directly to China probably use "spoofing" (identity impersonation) and origin falsification to reduce the risk of secondary sanctions or tariffs.

Five tankers, chartered by "traders," presumably a Vitol subsidiary, were responsible for bringing diluent and products in exchange for crude that was sent to the US. A total of 90 Mbpd had that destination.

In the petrochemical sector, methanol plants operate at almost 90%, while Fertinitro plants in José are out of service for maintenance and natural gas restrictions.