M. Juan Szabo [1] y Luis A. Pacheco [2]

Published Originally in Spanish in LA GRAN ALDEA

Throughout most of 2025, oil market analysis has been shaped by a long-term perspective colored by widespread pessimism about the economy as a whole. On the other hand, immediate elements, such as fundamentals based on verifiable physical data, appear less focused and with less weight in the market. This perspective of the distant, centered on possible apocalyptic scenarios, has caused a significant drop in crude oil prices, falling to levels not seen since the pandemic in early 2021. In the first four months of the year, a 17% decrease was recorded.

This sort of market Hypermetropia, focusing on the distant and neglecting the near, has begun to show symptoms of correction, and the signals implicit in the reduction of inventories in recession and a demand that grows without pause are becoming clearer. This new perspective has also been supported by some positive news emerging from the commercial labyrinth created by President Trump's tariff threats. News of negotiations with the United Kingdom, and expectations derived from the initial positioning of the U.S. and China in their task of agreeing on a mutually beneficial trade policy, are considered positive. In the short term, these news items leverage the rise in oil prices; the oil price recovered a small part of the value lost so far this year, 4.5% in the week.

Fundamentals

OPEC oil production fell slightly in April, despite the entry into force of a scheduled increase in pumping. According to a Reuters report, OPEC countries pumped 26.60 million barrels per day in April, a reduction of thirty thousand barrels per day, compared to March. The U.S. sanctions pressure to enforce oil sanctions imposed on Venezuela and Iran, and lower production in some countries (Iraq and Libya) from OPEC's secondary sources, negatively impacted the reported production figures. The OPEC+ figures, although not based on official information, also show a discrete lag, except for Kazakhstan, where an additional increase in production is observed, approaching one million nine hundred thousand barrels per day - see the graph below.

Meanwhile, in the U.S., production continues its slow decline, which we estimate at 3% annually —a trend projected based on drilling activity levels and the number of fracturing crews. Baker Hughes reports that in the week, another 6 rigs were taken out of service, both on land and offshore. Based on field data, we estimate that the number of fracturing jobs was reduced by 8% over the last 30 days. The Energy Information Administration (EIA) reported a reduction in U.S. commercial crude inventories of two million barrels, a significant decrease considering that oil imports were almost four million barrels higher than the previous week. The Federal Reserve (FED) decided not to modify interest rates. Although some analysts considered that conditions existed to do so, the FED argues that inflationary threats persist. The Trump administration will surely interpret this decision as contrary to its interests and will increase tensions with Jerome Powell, the head of the agency.

China continued its program of purchasing Russian, Iranian, and Venezuelan crude oil despite U.S. pressure, which resulted in the sanctioning of another Chinese refinery. The Asian giant is expected to report economic results for next week. Credit growth has improved this year, but April figures are unlikely to reflect results from the latest People's Bank of China measures to ease monetary policy.

Geopolitics

The most recent war focus seems to have been calmed, for now. India and Pakistan agreed on Saturday to a ceasefire after talks promoted by the U.S. to end the most serious military confrontation in decades between these historic rivals, a very delicate confrontation given that both possess nuclear weapons. The ceasefire agreement comes after several weeks of clashes, triggered by a massacre of tourists last month, for which India holds Pakistan responsible, which denies the accusation. The truth is that on the same day, there were violations of the negotiated ceasefire, and we cannot expect a quick solution to this recurrent conflict.

Russia commemorated on Friday the 80th anniversary of the Soviet Union's victory over Nazi Germany in World War II. The military parade proceeded normally despite a series of Ukrainian drones launched against Russian airports, causing flight rescheduling and temporary closures of facilities.

President Vladimir Putin, the Kremlin chief with the most years of service since Joseph Stalin, was alongside China's Xi Jinping and several dozen other world leaders and Russian veterans in a covered grandstand next to Lenin's mausoleum, as Russian troops marched. Meanwhile, Russia launched a ballistic missile and a barrage of drones against the Ukrainian capital. On Saturday, after the celebrations, the Kremlin accused European countries of making contradictory and conflicting statements, after European leaders backed a U.S. plan for a 30-day ceasefire in Ukraine and threatened Russia with "massive" sanctions if it did not sign it or did not comply.

In the Middle East, Lebanon and Syria are taking drastic measures against Palestinian factions that for decades have had an armed presence in both countries and that, on some occasions, were used to plan and launch attacks against Israel. This crackdown comes as Syria's new rulers, under the Islamist group Hayat Tahrir al-Sham, persecute officials from the previous government of Bashar al-Assad. Syria's most prominent Palestinian factions were key allies of the Assad dynasty, both in times of war and peace, and cooperated closely on security matters. It also comes after Iran's main regional ally, the Lebanese militant group Hezbollah, was weakened after more than a year of war with Israel, and as the new Lebanese government promises to restore control over all weapons in its territory, including those of Hezbollah and other Palestinian factions in Lebanon.

On Wednesday, Syrian President Ahmad al-Sharaa declared that his government is holding indirect talks with Israel through mediators. He added that these indirect negotiations aim to ease tensions between the two countries following intense Israeli airstrikes against Syria. Israel is likely to welcome the new policy of controlling hardline Palestinian factions, including Palestinian Islamic Jihad, which participated alongside Hamas in the October 7, 2023, attacks in Gaza.

Israel's military attacked Houthi rebels in Yemen's Hodeida province on Monday with a series of air raids. The attacks came a day after the Iran-backed rebels launched a missile that hit near Israel's main airport. The rebels' press office reported that at least six strikes hit the crucial port of Hodeida on Monday afternoon. Other attacks hit a cement factory in the Bajil district, located 55 kilometers northeast of Hodeida city.

In summary, it has been a week of discrete yet positive steps toward conflict resolution, although it is merely a glimmer of hope at the end of the tunnel. As such, it did not affect the levels of geopolitical risk that the oil market factors in. The election of an American as POPE Leo XIV could introduce new dynamics in geopolitics, although it is too early to speculate.

Price Dynamics

Crude prices rose this week following the announcement of a trade agreement between the U.S. and the United Kingdom and on hopes that an agreement could be reached with China. In any case, the fundamentals —inventory, demand, and supply — provided a solid foundation for this partial recovery. Indeed, Brent crude prices in the international oil market approached $64/bbl and WTI prices surpassed $61/bbl, representing an increase of around 4.5% compared to the previous week.

Energy Transition and Trade War

In the past, we have written about the importance of geopolitics in materials for the energy transition, a topic that takes center stage in the trade war scenario the world is in. China is the world's leading supplier of "rare earths," and given their importance, it has already begun to limit their global trade. In the same vein, the recently signed agreement between the U.S. and Ukraine, for the joint exploitation of mineral resources, has as one of its key points the mining of "rare earths," which have undoubtedly become a set of strategic materials that drive new geopolitical tactics.

Another element that raises a red flag of potential scarcity and, therefore, affects the energy transition, is copper. Copper is key to essential industries of the future, such as the development of renewables, increased electrical demand for artificial intelligence, the manufacture of electric vehicles, and the push for larger and more sophisticated transmission networks. Approximately 50% of the world's copper reserves are concentrated in five countries: Chile, Australia, Peru, the Democratic Republic of the Congo, and Russia, the latter two of which are involved in ongoing armed conflicts.

The recent escalation of tariffs could become a significant obstacle to the growth of copper production, processing, recycling, and manufacturing, from its production in mines to its use in final products. Not to mention the problem of obtaining permits to mine copper increasingly deeper and with less content.

Studies indicate that, despite copper being produced in several countries that sell their raw material, China overwhelmingly dominates the refining of this metal. It is in this phase that the actual added value of the sector is centered. China imports 60% of the world's copper ore to produce 45% of the world's refined copper material. China holds all these cards up its sleeve when negotiating agreements with belligerent trading partners, such as the U.S.

VENEZUELA

Last-minute Lobbying

OFAC's General License No. 8, which regulated the operations of U.S. oil service companies in Venezuela, expired on May 9, just weeks before the conclusion of oil operations covered by General License 41, among others, on May 27.

In this complicated scenario for the Venezuelan regime, it has activated all its lobbying tools, including some analysts and commentators. The television appearances of Chevron's CEO, tweets from Richard Grenell (White House advisor) and Linda Loomer (influencer associated with Trump), and retweets by professionals dedicated to this work, united by the narrative of the danger of leaving vacant the oil spaces currently in the hands of Western companies and allowing Chinese and Russian interests to come in, have raised the volume of their campaign. The campaign of these actors is of such magnitude that the Secretary of Energy and representatives of the State Department have had to come out to reaffirm that the current policies regarding the cancellation of licenses and other complementary policies continue in effect. Added to all this, flights of deported Venezuelans continue to arrive in the country.

On the domestic policy front, Tuesday dawned with the surprising announcement by the U.S. Secretary of State, Marco Rubio, informing that the five opposition people detained at the Argentine embassy for more than 400 days had been "successfully extracted" and were in U.S. territory. The following day, regime officials attempted to downplay the significance of the event, suggesting that it was the result of a negotiation. Representatives from the U.S., Argentina, and Brazil denied that negotiations had taken place. Nicolás Maduro was out of the country during the release of these hostages, attending the celebration of the 80th anniversary of the Soviet victory over Nazi Germany. The regime gave wide coverage to the visit to Moscow, trying to mitigate the propaganda effect of the release. Still, Minister Cabello's attempts to explain the event had the opposite effect.

The general elections, scheduled for May 25, remain on course; even this weekend, the CNE was inviting voters to participate in an electoral simulation. Curiously, the economic issue, which is the central problem of the regime, passes under the table in an electoral process that focuses on speeches with little content on the issues that affect the electorate. The Central Bank of Venezuela (BCV) is intervening in the foreign exchange market with a greater volume of foreign currency, aiming to narrow the gap between the official and parallel rates.

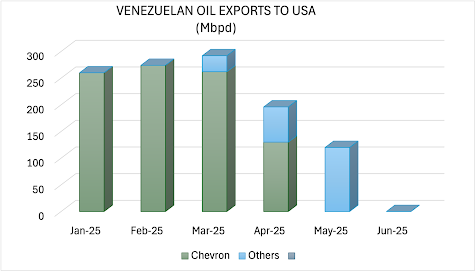

The vertiginous increase in inflation is the direct result of this economic scenario generated by the scarcity of foreign currency. This situation will worsen if, as expected, on May 27 the operational contributions of international private companies in oil activity conclude (see Graph below).

Oil Operations

Activities in the hydrocarbon sector have experienced fluctuations over the last week. But it is exportation that is undergoing the most significant transformation in the face of the expiration of OFAC licenses.

Crude production during the last week averaged eight hundred and sixty thousand barrels per day (860 Mbpd), geographically distributed as follows:

AREA Mbpd

• West 215

• East 125

• Orinoco Belt 520

• TOTAL 860

National refineries processed 220 thousand barrels per day (200 Mbpd) of crude and intermediate products. The FCC unit at Cardón was started after a prolonged maintenance period and is operating at less than half its design capacity. Gasoline production was 83 Mbpd, and diesel was 73 Mbpd. In what appears to be an attempt to reinforce the narrative that Chinese companies would take control of the oil industry, rumors were spread about Chinese companies preparing to take over refinery operations in Paraguaná.

The number of tankers at Venezuelan terminals has been reduced to nearly a third of last month's peak. However, in Lake Maracaibo, up to 6 tankers were being used as cabotage to transfer crude to larger tankers on the high seas. It is still early to estimate crude exports for May, but it could be in the order of 500 Mbpd.

[1] International Analyst

[2] Nonresident Fellow, Baker Institute

No comments:

Post a Comment