M. Juan Szabo [1] y Luis A. Pacheco [2]

Published Originally in Spanish in LA GRAN ALDEA

The development and outcome of the open military confrontation between Israel and Iran, inherently difficult to predict, takes a new path now that the White House has decided to intervene militarily in Iranian territory, under the argument that it seeks to accelerate a negotiated peace. In a region that concentrates a high proportion of the world's hydrocarbon industry, the surprising but not unexpected Israeli air attack and Iranian response are not minor events and raise the risk that an "accident" could trigger escalation in a traditionally volatile region. The world's most important oil facilities are directly or indirectly exposed to being affected by the conflict, which can shake the global energy market.

US Military Intervention

During the week, President Trump threatened the regime of Ayatollah Ali Khamenei with reprisals if it did not agree to his demands to negotiate a nuclear agreement. The threats were accompanied by granting a two-week deadline for Iran to abandon its uranium enrichment program, raising doubts about the real intentions of the US.

In what is already almost a standard tactic of the White House occupant, Trump ignored the deadline he established and surprised with military intervention in the conflict. On Saturday, the US Air Force attacked three targets of Iranian nuclear infrastructure: Fordow, Natanz, and Isfahan, with the declared objective of forcing negotiation and, it is speculated, a change in the Iranian regime.

Impact on Oil Markets

All these variables have elevated the price and volatility of oil to their highest levels since the beginning of the year, and the effect of the US incursion is already beginning to materialize in crude oil prices at the start of the new week, faced with threats, this time, from the Iranians.

All other factors that typically move market actors have been relegated to second place this week. Chinese demand, the reduced effect of OPEC+ production increases, falling crude oil inventories in the US, and Federal Reserve decisions became merely sterile statistics for oil market purposes. Oil analysts transform, at least for now, into military observers.

Geopolitics

Impact on Oil Infrastructure

From the perspective of global hydrocarbon production and supply, the war between Israel and Iran, contrary to past Middle East conflicts, has not had serious repercussions so far. Destruction in oil infrastructure, due to missile exchanges and air bombardments, is limited to damage to facilities at a refinery associated with the South Pars gas and condensate field in Iran, and to an Israeli refinery in Haifa. Even the Tamar gas field, in Israeli territorial waters, has been reopened to supply natural gas to Egypt. Nevertheless, the situation has increased tanker freight prices, affecting economies globally.

Pressure on Maritime Routes

The US has pressured Yemen's Houthis with commercial sanctions and bombardments of their missile launch facilities, to maintain free passage through the Bab el-Mandeb strait and as a precaution against any potential closure or limitation of passage through the Strait of Hormuz; a possible, though currently improbable, reaction to the US incorporation into the conflict.

Damage to the Iranian Nuclear Program

The war enters its second week, and damage to Iran's nuclear program is significant. Still, its capacity to reestablish its nuclear aspirations, which would be naive to think they will abandon, is unknown. Much of the military command appears to have been eliminated, and as part of the attacks on Natanz and Fordow near Qom, much of the key scientific personnel of the nuclear program as well. Ayatollah Ali Khamenei is under protection and supposedly has named his successor in case he is assassinated.

Fordow Operation

A key element in the US operation was the destruction or disabling of facilities at Fordow, located near the city of Qom, equipped with five tunnels and hidden inside a mountain 60 meters deep, and which, according to the Israeli government, stores the enriched uranium necessary to manufacture nuclear weapons. The US used in its Saturday attack its "Massive Ordnance Penetrator" (MOP GBU-57), a projectile capable of drilling through mountains and penetrating more than 60 meters before exploding. This weapon presumably would allow destroying those underground facilities, though beyond White House announcements, the extent of damage caused remains to be confirmed.

Damage in Israel

In Israel, despite more than 90% of missiles and drones launched by Iran having been destroyed, some caused significant damage, as is the case with the Weizmann Institute. Although no one died in the attack, several campus laboratories were destroyed, ending years of scientific research. At the same time, Israeli scientists were reminded that they are also in the crosshairs of the conflict.

Diplomatic Situation

There has been no progress on the diplomatic front. The summit held in Geneva with Iran's foreign minister and European leaders yielded no signs of advancement, and the UN Security Council meeting ended with Iran and Israel exchanging insults and without any conclusion.

Subsequently, President Trump dismissed the European initiative, suggesting that a diplomatic solution would require US intervention. That was when he opened the two-week deadline for negotiations with Iran, which was later bypassed. Markets now anxiously await Iran's response to the US attack.

Russia-Ukraine Conflict

On the Russia/Ukraine front, after concluding an exchange of bodies of soldiers fallen in combat, the parties continued exchanging drone attacks, with Russia taking advantage of summer and the presence of additional troops from North Korea. Russia expects an agreement on the date of the subsequent peace talks with Ukraine next week. However, it wouldn't be strange if Putin uses the US attack on Iran as a strategic piece.

European powers continue to consider Russia a potential enemy and are about to impose new incremental sanctions, starting with the prohibition of reactivating the "Nord Stream" gas pipelines. Putin seems more interested in intervening as a mediator to defend his Iranian partner than resolving his own war. He probably considers that after the fall of his partner in Syria, the loss of Iran would be a hard blow.

Regional Geopolitical Strategy

Some geopolitical strategists suggest that the underlying objective of US policy is to pacify the Middle East, establish the "economic corridor" India—Middle East—Europe, a supply chain with enormous potential, and constitute a strategic response to China's initiative called "Belt & Road."

Fundamentals

Federal Reserve Monetary Policy

Despite being overshadowed this week, oil market fundamentals generally showed positive readings regarding market health.

The Federal Reserve (FED) decided not to move interest rates in the US, although the White House has expressed interest in a reduction, which would have provided relief in debt service. The FED pays more attention to the future of inflation due to energy price increases than employment figures and generally lower economic growth in America.

Oil Financial Discipline

Despite the increase in oil prices, US oil companies maintain their financial discipline policy for eminently geopolitical reasons. Operational activity remains stagnant in terms of production. They continue to reduce activities to generate new production potential.

Crude Oil Inventories

The Energy Information Administration (EIA) published its weekly statistics, revealing an unusual fall in commercial crude inventories (-11.4 million barrels). An abnormally large drop that will need to be analyzed later, based on indicative trends over several weeks.

OPEC Production

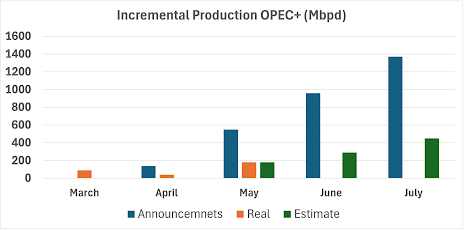

Another relevant element for supply levels experienced in recent weeks is the increase in OPEC+ crude oil production, in compliance with their announcements. Considering announcements for April, May, June, and July (see attached chart), compliance looks meager, especially if we take into account that Kazakhstan has maintained its overproduction essentially constant.

European Energy Policies

In Europe, while Norway is deploying a high level of oil activity, including exploratory, the United Kingdom government has issued a new set of strict environmental standards for new fossil fuel projects. The standards require that so-called Scope 3 emissions (those produced in the use of extracted fuels) be included in the environmental impact assessment of any project. This is an example of ideology imposing itself on the reality of energy supply.

Asian Demand

On the demand side, June is shaping up as crude oil purchases near May levels for both China and India, representing a recovery compared to the beginning of the year.

Price Dynamics

Crude oil prices moved to the rhythm of the risk of interruption in the hydrocarbon value chain, in a wide range, between $70 and $79/BBL. At the end of the week, a modestly bearish trend was experienced after the announcement that Trump would delay the deadline for possible US participation in the conflict. In any case, prices closed the week with a gain of more than 3% compared to the previous week, placing themselves at February 2025 levels. Thus, at market close on Friday, June 20, the Brent and WTI benchmark crudes were trading at $77.01/bbl and $73.84/bbl, respectively.

At the close of this note, and after the US attack on Iranian nuclear facilities, prices seem to be awaiting a possible Iranian reaction, and with a slight downward trend. And in an attention-grabbing statement, President Trump "ordered" oil companies to keep prices low.

VENEZUELA

A Confidential Economy

It is said that having access to foreign currency is the most challenging thing in Venezuela. However, obtaining official statistics is even more difficult because they are not published. Unofficial figures, the result of private research, have also disappeared amid the regime's repressive wave against analysts and economists; the regime seems to have decided to ban thermometers to avoid recognizing the fever.

Economic Indicators

Economically, we know, through the Central Bank of Venezuela (BCV), that the official exchange rate is close to 105 Bs./$, a depreciation of more than 50% compared to the beginning of this year. The parallel market rate has disappeared from public spaces, although foreign portals estimate it at 142 Bs/$. The inflation rate is not published either, but the equation: foreign currency shortage + monetary financing + Bolivar depreciation, can only result in growing inflation and negative economic growth.

Benefits of Oil Prices

The only aspect that has given a slight respite to the economy is oil prices, which have increased for geopolitical reasons. In June, the weighted prices of Venezuelan exports rose to almost $33/BBL. According to our calculations, for each dollar increase in the Brent benchmark crude price, Venezuela should receive, assuming total transparency in collection, an additional $0.5/BBL. In other words, Brent rising from $70 to $77/BBL would result in an extra $3.5/BBL, around $70 million monthly.

Anti-Sanctions Model

By June, the "Anti-Sanctions Model" is in operation. It is based on:

- Maintaining exports near the same pre-June level.

- Reduction of public spending to limit monetary financing.

- Foreign currency for delivery destined for "first necessity" activities.

- Structuring an alternate collection system, with emphasis on barter and cryptocurrency.

With this defensive strategy, Nicolás Maduro, Delcy Rodríguez, and the BCV hope that economic stagnation does not become chronic.

International Political Position

Politically, after Israel attacked Iran, Nicolás Maduro ratified his support and solidarity with Iran. In a televised act, he said: "We firmly ratify our absolute solidarity with the people of the Islamic Republic of Iran, with the Palestinian people, with the Syrian people, with the Lebanese people, with the Yemeni people and with all Muslim peoples and Arab peoples."

Oil Operations

Production Scheme

In this first month of the new scheme, which we call the "Anti-Sanctions Model," PDVSA focused on producing through joint ventures (JV) and production participation contracts (PPC) with private companies willing to maintain activities without OFAC authorization from the US. Exports concentrated on sending crude and products to China through mechanisms we have already analyzed in previous writings.

Crude Oil Production

Crude oil production during the last week averaged eight hundred forty-seven thousand barrels per day (847 Mbpd), distributed geographically as follows, in MBPD:

Area | Mbpd |

West | 213 |

East | 121 |

Orinoco Belt | 513 |

TOTAL | 847 |

National Refining

National refineries processed 216 MBPD of crude and intermediate products, yielding 80 MBPD in gasoline and 71 MBPD in diesel.

Exports

June export figures point to a monthly average of about 570 Mbpd. Seven tankers were dispatched in the first 20 days, and at least five more are expected before the end of the month. All shipments are destined for the Far East except one for Cuba.

Petrochemical Sector

Methanol plants in the petrochemical sector operate at almost 86% of their capacity. At Fertinitro, one ammonia and urea train operates, and Superoctanos is out of service.

CITGO

On Friday, OFAC published General License 5S. Through this license, CITGO assets are protected from the holders of the so-called PDVSA 2020 bond, who are still awaiting a decision from a court in New York. Meanwhile, the auction process for CITGO assets in Delaware court continues on its path of advances and setbacks; an announcement from the case judge is expected in the next two months.

[1] International Analyst [2] Nonresident Fellow Baker Institute

No comments:

Post a Comment